Incoterms® is an abbreviation for “International Commercial Terms.” This term represents a very useful way of communication and it’s actually aimed at reducing confusion between buyers and sellers.

Incoterms® is an abbreviation for “International Commercial Terms.” This term represents a very useful way of communication and it’s actually aimed at reducing confusion between buyers and sellers.

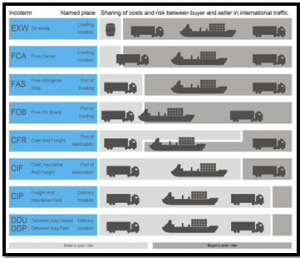

So what is an incoterm? An incoterm represents a universal term that defines a transaction between importer and exporter so that both parties understand the tasks, costs, risks, and responsibilities, as well as the logistics and transportation management from the exit of the product to the reception by the importing country. Incoterms are all the possible ways of distributing responsibilities and obligations between two parties. It is important for the buyer and seller to pre-define the responsibilities and obligations for the transport of the goods.

Here are the main responsibilities and obligations:

- Point of delivery: here, the incoterms defines the point of change of hands from seller to buyer.

- Transportation costs: here, the incoterms define who pays for whichever transportation is required.

- Export and import formalities: here, incoterms define which party arranges for import and export formalities.

- Insurance cost: here, incoterms define who takes charge of the insurance cost.

Advantages of using incoterms:

- As they stand today, there are 11 main terms and a number of secondary terms that help buyers and sellers communicate the provisions of a contract in a clearer way; therefore, reducing the risk of misinterpretation by one of the parties.

- Incoterms govern everything from transportation costs, insurance to liabilities. They contribute to answering questions such as “When will the delivery be completed?” “What are the modalities and conditions for transportation?” and “How do you ensure one party that the other has met the established standards? Having said that, it is important to remember that there are also limits to Incoterms. For example, they do not apply to contractual rights and obligations that do not have to do with deliveries. Neither do they define solutions for breach of contract.

Here’s what you should know about incoterms:

- Ex Works (EXW) – The seller makes the goods available at its location, so the buyer can take over all the transportation costs and also bears the risks of bringing the goods to their final destination.

- Free Carrier (FCA) – The seller hands over the goods into the disposal of the first carrier. After the buyer takes over all the costs, the risk passes when the goods are handed over to the first carrier.

- Free Alongside Ship (FAS) – The seller must place the goods alongside the ship at the named port, the risk of loss or damage to the goods passes when the goods are alongside the ship, and the buyer bears all the costs from that moment on.

- Free on Board (FOB) –The seller must load the goods on board of the ship, nominated by the buyer. Cost and risk are divided when the goods are actually on board.

- Cost and Freight (CFR) –Seller must pay the costs and freight to bring the goods to the port of destination. Although the risk is transferred to the buyer when the goods are loaded on the ship.

- Cost, Insurance and Freight (CIF) –It’s exactly like CFR except that the seller must in addition procure and pay for the insurance.

- Carrier and Insurance Paid to (CIP) –The seller pays for the carriage and insurance to the named destination point, but risk passes when the goods are handed over to the first carrier.

- Delivered Duty Paid (DDP) –The seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination.

You will find a handy Incoterms 2010 Quick Reference Guide on the Logistics Plus website. Additionally, you can check out our short Introduction to Incoterms 2010 Webinar online.