by logisticsplus | Mar 8, 2017 | News

What is Break Bulk Shipping? The term break bulk comes from the older phrase “breaking bulk” which is the extraction of a portion of the cargo on a ship, or the beginning of the unloading process from the ship’s holds. In modern context, break bulk is meant to encompass cargo that is transported in bags, boxes, crates, drums, or barrels – or items of extreme length or size. To be considered break bulk, these goods must be loaded individually, not in intermodal containers nor in bulk as with liquids or grains.

What is Break Bulk Shipping? The term break bulk comes from the older phrase “breaking bulk” which is the extraction of a portion of the cargo on a ship, or the beginning of the unloading process from the ship’s holds. In modern context, break bulk is meant to encompass cargo that is transported in bags, boxes, crates, drums, or barrels – or items of extreme length or size. To be considered break bulk, these goods must be loaded individually, not in intermodal containers nor in bulk as with liquids or grains.

Break bulk was the most common form of cargo for most of history. Since the late 1960s, break bulk cargo has declined while containerized cargo has grown significantly. Moving containers on and off a ship is much more efficient than having to move individual goods. This efficiency allows ships to minimize time in ports and spend more time on the sea. Break bulk cargo is also more susceptible to loss, theft and damage.

Loading and unloading break bulk cargo can be very labor-intensive. Generally such cargo is brought to the quay next to the ship, and then each individual item is lifted on board separately – oftentimes using heavy-duty cranes from the boat or by the dockside. Once on board, each individual item must be secured and stowed separately as well.

Examples of commonly shipped break bulk cargo commodities include:

- Bagged or sacked cargo

- Bailed goods

- Barrels, drums, and casks

- Corrugated and wooden boxes or containers

- Reels and rolls

- Equipment, vehicles and components

- Steel girders and structural steel

- Any long, heavy or over-sized goods

The biggest challenge when shipping break bulk cargo is that it requires more resources and coordination – longshoremen, loading and unloading cranes, warehouses, specialized ships, transport vehicles, etc. That’s why working with an experienced and capable break bulk logistics company can make all of the difference in the world. Logistics Plus has 20 years of break bulk and project cargo experience. We’ve shipped every sort of break bulk cargo imaginable: locomotives, airplane components, tugboats, pipes, tanks, transformers windmills, and so much more! Some people call this type of cargo “the big, the bad, and the ugly” … but that’s exactly the type of logistics project we love to handle!

If you have any upcoming break bulk shipments, just click the banner below to give us a try … or email us at projectcargo@logisticsplus.com!

by logisticsplus | Mar 7, 2017 | News

Overview. 2016 business reports show that U.S. exporters exported $2.2 trillion worth of goods and services. This was about 12% of total economic output in GDP terms. Keep in mind that only 1% of American businesses export their products. Based on the report, the U.S. is the 3rd largest exporter in the world right behind China and the EU, with Germany coming in at fourth place. This is a slight drop in total U.S. market share both in actual terms and as a percentage of global exports. Most of America’s exports are goods as well as service sector based products. The intangible nature of services makes them harder to export across countries and regions.

Overview. 2016 business reports show that U.S. exporters exported $2.2 trillion worth of goods and services. This was about 12% of total economic output in GDP terms. Keep in mind that only 1% of American businesses export their products. Based on the report, the U.S. is the 3rd largest exporter in the world right behind China and the EU, with Germany coming in at fourth place. This is a slight drop in total U.S. market share both in actual terms and as a percentage of global exports. Most of America’s exports are goods as well as service sector based products. The intangible nature of services makes them harder to export across countries and regions.

Top U.S. Exports

$1.46 of the $2.21 trillion exported items comprised of goods and items. This means two-thirds of what America exported were commodities. The products fall into seven categories. These are capital goods, industrial supplies & equipment, consumer goods, automobiles, agricultural products, and services.

- Capital Goods. A little over $500 billion worth of capital goods were exported mostly from 6 broad categories. These are Industrial machines ($51 billion), Commercial Aircraft ($121 billion), and Medical equipment ($35 billion). The others are telecommunications ($41 billion), semiconductors ($44 billion), and Electric apparatus ($42 billion).

- Industrial supplies and equipment. In 2016 the U.S. exported $398 billion worth of materials used. Most of these are oil and oil-based products. Chemicals topped the list followed by fuel oil, then petroleum products, and plastic. Non-monetary gold closed this list at $20 billion.

- Consumer goods. These constitutes 13% of the goods exported valued at about $200 billion. The breakdown is pharmaceuticals ($53 billion), cell phones ($24 billion) and gem diamonds ($21 billion). Consumer spending is influenced by disposable income, income per capita, living wage, household debt, consumer expectations and inflation rates

- Automobiles. These constitute 10% of the exported goods and services averaging about $150 billion. GM, Chrysler, and Ford are the largest cars manufacturers. There are a few smaller ones also in the market. The output has been growing significantly after taking a dip during the 2008 financial crisis.

- Agricultural products. At $131 billion this is one of the largest products exported from the U.S. markets. They tend to be generally cheaper since they receive lots of government subsidies. Bioengineering and chemical additives have helped to boost production and supply of agricultural products. Soybeans ($24B), Meat and poultry ($17B) and Corn ($11B) are the top three exported goods.

- Services. This constitutes one-third of U.S. export to global markets. It totals about $750 billion. Most of the exported services in the exported commodities and items. The largest service export is aircraft services ($293B), Computer & Related services ($178B), Intellectual property and royalties ($120B) and banking ($113B) as well as defense ($20B).

Challenges Facing the United States Exporting Sector

The United States export market has shrunk globally due to the emergence of developing industrial economies like Brazil, India, China, and Indonesia. These countries have developed industrial units that manufacture most of the goods for the local market which in turn lowers demand for American products.

- Secondly is standards of living. These countries have lower standards of living. This allows them to produce goods at a cheaper rate. The lower standards of living enable them to erode America’s competitive and comparative advantages across lots of industries. When it comes to automobiles Japanese, and European car makers producers better quality and cheaper cars that are well suited for global markets.

- Third, is the issue of oil. America is both a huge producer and importer of oil. That’s because they produce a lot yet their demand is even hired. Keep in mind that some of the oil that they produce does not meet their consumption standards, so they export it to Africa. Most of the oil produced is shale oil. America therefore still spends much more on buying oil abroad.

- American Trade Deficit. American trade deficit as of 2016 stood at $500 billion. We imported $2.7 trillion worth of goods and services while exporting $2.2 trillion. This is about $25 billion higher than 2013. This can mostly be attributed to the strengthening of the dollar by 25% between 2013 and 2016. Even then this deficit is $200 billion less than 2006 meaning, the value is on a general upward trend. The primary drivers of this deficit are consumer products (-$397B) and automobile (-200B) deficit.

- The deficit with Major Trading Partners. America’s top trading partners are China ($580B), Canada ($545), Mexico ($525B). The deficit with China stands at about $347B making them responsible for 70% of our deficit. This deficit significantly weakens the economy since the economy ends up being financed by debt which has to be paid back with interest. The dollar is said to have declined 40% between 2001 and 2007. This in turn weakness America’s competitiveness on the global stage.

Opportunities for U.S. Exporters

Despite the challenges, it’s not all gloom and doom. America has certain old and emerging opportunities on the export front. The U.S. exported $2.209 trillion worth of exports in 2016. America has a lot of potential given that this constitutes export from

1% of American firms only.

- The U.S. Dollar Is King. American competitiveness is still pegged on the good fortune of having the dollar as the world reserve currency. This minimizes the shocks that the economy might have to take in the short and medium term. The dollar still accounted for 62% of global bank reserves still ahead of the pond, Euro, Yen, and Yuan. This I good news for small time exporters in the market.

- African Renaissance. The growth and rise of African economies have created a middle class (est. 15% of pop) that has an increasing demand for American goods. Any small or medium-sized exporter who targets this market will greatly benefit. The purchasing power of African consumers haves been on a general upward trend over the past 15 years. Economies of Kenya, Nigeria, South Africa, Ethiopia, Egypt, and Congo continue to prove versatile in the face of internal challenges and shocks. They also have massive infrastructural spending that lifts the nation’s ease of doing business.

- Investors and Technology. The U.S. continues to lead as the most attractive market for investors especially from the developing Asian economies. That’s why the U.S. continues to get hundreds of billions in capital inflows. The Foreign Direct Investment inflows stood at $736B in 2016. That accounts for 15% of the global totals or $1 in every $6. Additionally, people still flock to the U.S. as tech innovators and inventors. It’s still the home to major social players and towers in spending levels.

Ready to start exporting? Have questions or need a reliable logistics partner? The export specialists at Logistics Plus are ready to help.

by logisticsplus | Mar 6, 2017 | Uncategorized

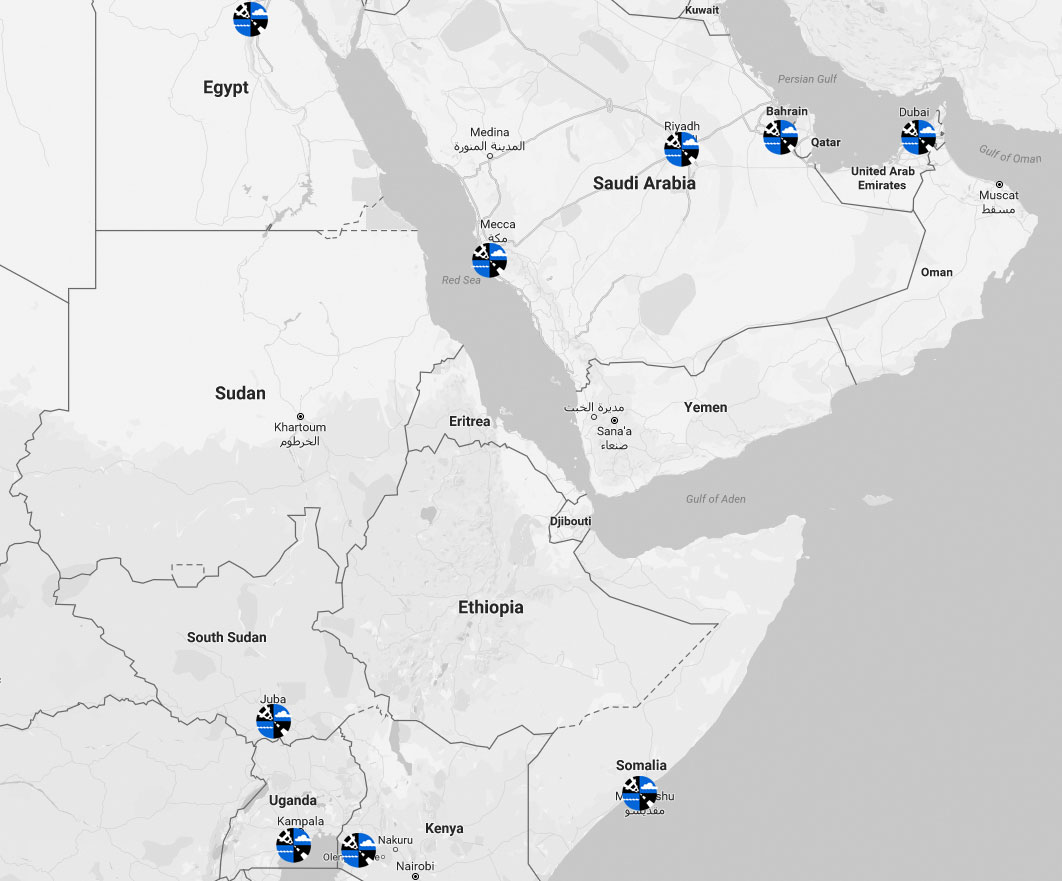

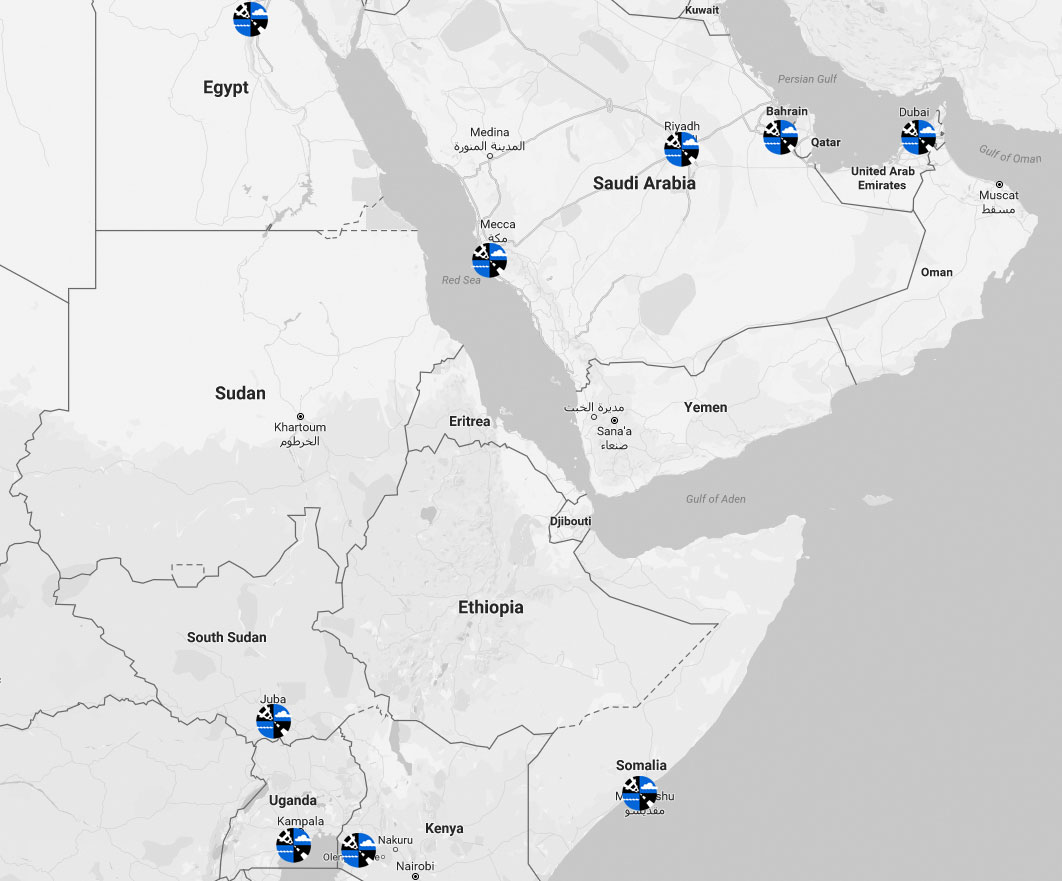

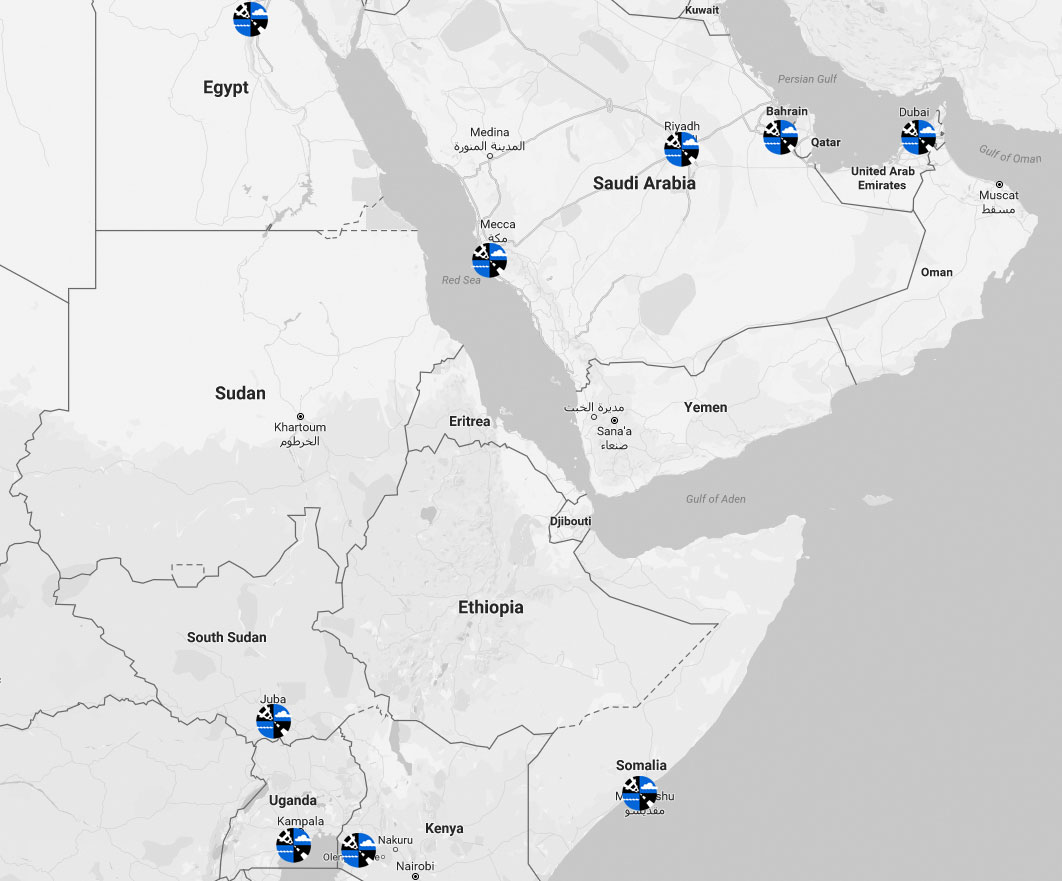

The Logistics Plus (LP) Middle East and Africa offices continue to enjoy fast growth and success within the region. Here are some updates from the LP team operating within this important area of the world.

The Logistics Plus (LP) Middle East and Africa offices continue to enjoy fast growth and success within the region. Here are some updates from the LP team operating within this important area of the world.

Logistics Plus Dubai (UAE)

- LP Dubai primary team members: Suchit Sehgal, Siew Hua, Anjali Malik, Dhanraj Naidu, Ramesh Reddy, Reuben Alphonse, and Ronan Yuchitcho.

- Handling 100% of refurbished engine shipments for major power company. Additional shipments for Rwanda plant to begin Q3 2017.

- Moving shipments from UK, China and Germany to the Middle East for worldwide office furniture manufacturer. Quoting additional warehousing operations in Jebel and Dubai.

- Moved first shipment for a major painting and coatings manufacturer. Multiple more shipments are in the pipeline with support from LP Turkey.

- Moving shipments for cement company with plant located in Ras al-Khaimah.

- Bidding on multiple power transmission projects in Malawi and Ethiopia for major global power company.

- Moving agricultural company shipments from Ethiopia to Middle East with opportunity for 30-50 containers per month.

Logistics Plus Kingdom of Saudi Arabia (KSA)

- LP Jeddah primary team members: Raza Rizvi, Bakar Jafar, Omar Khalid, and Imran Ramzan.

- Handling over 1,000 40′ HC containers per month for major electric company.

- Secured small contract to support logistics for a marine cargo company.

- Hotel project in Saudi Arabia for a prominent leader in the agribusiness.

- Working with an association partner to move regular shipments from Saudi Arabia to UAE.

- Bidding on multiple projects in Dammam and Rabigh in support of local freight forwarder.

Logistics Plus East Africa (EA)

- LP Uganda primary team member: Julius Nyaika

- Bidding and handling various tenders for the United Nations (UN).

- Making in-roads with various companies in the oil and gas industry.

- Moving animal feed to and within Sudan in conjunction with a regional airport operator.

- Bidding on multiple projects in Kenya and Uganda in support of a major transport and logistics operator.

- Working with a Chinese petroleum company on multiple projects in East Africa.

Do you have supply chain or logistics needs in the Middle East or Africa? If yes, contact us and let our global experts go to work for you. Click the button below to complete our online inquiry form, or email suchit.sehgal@logisticsplus.com – our general manager for the Middle East and Africa

by logisticsplus | Mar 2, 2017 | News

The Logistics Plus (LP) S.W.A.T. team recently completed “Phase 2” of the WeWork Merchant’s Row office installation in Detroit, MI. WeWork Merchant’s Row features seven unique floors of office space in a restored historic building. Those who move into this coveted address right on Woodward Avenue will gain direct access to the heart of downtown’s renaissance. WeWork Merchant’s Row blends co-working spaces with private offices, common areas with conference rooms, and historical details with modern decor. Teams of any size in industries like design, tech, and marketing will appreciate the space and community that make this location like no other.

by logisticsplus | Mar 2, 2017 | News

FOR IMMEDIATE RELEASE

Logistics Plus Recognizes 2016 National and Regional LTL Carriers of the Year

FedEx Freight Presented with National Award and Dayton Freight Presented with Regional Award.

The LP team presents Monica Fronzaglio, worldwide account manager for FedEx Services, with its National LTL Carrier Award

ERIE, PA (March 2, 2017) – Logistics Plus Inc., a leading worldwide provider of transportation, logistics and supply chain solutions, recently recognized two of its less-than-truckload (LTL) carriers for superior results and performance in 2016. The annual awards were presented to the following carriers in each of two categories:

- FedEx Freight was named the 2016 Logistics Plus National LTL Carrier of the Year (Estes Express and UPS Freight were both runners up in this category)

- Dayton Freight Lines was named the 2016 Logistics Plus Regional LTL Carrier of the Year (Ward Transport & Logistics and New Penn Motor Express were both runners up in this category)

The LP team presents Patty Ash, corporate account manager for Dayton Freight, with its Regional LTL Carrier Award

Performing as a top North American freight brokerage firm, Logistics Plus LTL services are delivered through its proprietary eShipPlus™ transportation management system (TMS) – a complimentary online platform made available to all of its LTL customers. Its annual LTL carrier awards are based on internal and external assessments of the following performance criteria:

- Annual Share of Business and Growth

- Price Competitiveness

- Service Performance

- Billing Accuracy

- Customer Service

- Account Representation

“Logistics Plus has been buying, managing, and delivering LTL services to our many customers for 20 years. Although today we provide many other logistics solutions, LTL remains one of our core offerings,” said Scott Frederick, vice president of marketing and LTL carrier relations for Logistics Plus. “Having great, cooperative LTL carrier partners is critical to our LTL services program. We looked at annual performance reports, we polled our internal operations and accounting stakeholders, and we surveyed our end customers; and FedEx Freight and Dayton Freight both came out on top. I am grateful for the support we receive from all of our LTL carrier partners, but I would especially like to thank and congratulate FedEx Freight and Dayton Freight for their excellent performance in 2016.”

About FedEx Freight

FedEx Freight is the largest LTL carrier in North America with service throughout the U.S., Canada, Mexico and Puerto Rico, and to the U.S. Virgin Islands. FedEx Freight offers two reliable options: FedEx Freight® Priority, with the fastest published transit times of any nationwide less-than-truckload (LTL) service, and FedEx Freight® Economy for basic LTL freight shipping needs.

About Dayton Freight Lines

Founded in 1981, Dayton Freight is a private LTL freight carrier headquartered in Dayton, Ohio. With 50 Service Centers in the Midwest region, Dayton Freight offers shippers 1 or 2 day service to thousands of points throughout a 13 state area. With our Strategic Alliance Network, we can serve all of the United States, Canada, Mexico, Puerto Rico and Guam.

About Logistics Plus Inc.

Logistics Plus Inc. provides freight transportation, warehousing, global logistics, and supply chain management solutions through a worldwide network of talented and caring professionals. Founded in Erie, PA by local entrepreneur, Jim Berlin, 20 years ago, Logistics Plus is a fast-growing and award-winning transportation and logistics company. With a strong passion for excellence, its 400+ employees put the “Plus” in logistics by doing the big things properly, and the countless little things, that together ensure complete customer satisfaction and success.

The Logistics Plus® network includes offices located in Erie, PA; Alma, AR; Little Rock, AR; Los Angeles, CA; Riverside, CA; San Francisco, CA; Visalia, CA; Atlanta, GA; Chicago, IL; Detroit, MI; Kansas City, MO; Charlotte, NC; Lexington, NC; Buffalo, NY; Cleveland, OH; Charleston, SC; Greenville, SC; Nashville, TN; Dallas, TX; Fort Worth, TX; Houston, TX; Laredo, TX; Madison, WI; Bahrain; Belgium; Canada; Chile; China; Colombia; Egypt; France; Germany; India; Indonesia; Kazakhstan; Kenya; Libya; Mexico; Poland; Saudi Arabia; South Sudan; Turkey; UAE; and Uganda; with additional agents around the world. For more information, visit www.logisticsplus.com or follow @LogisticsPlus on Twitter.

###

Media Contact:

Scott G. Frederick

Vice President, Marketing

Logistics Plus Inc.

(814) 240-6881

scott.frederick@logisticsplus.com

Click image below to download the Logistics Plus logo:

What is Break Bulk Shipping? The term break bulk comes from the older phrase “breaking bulk” which is the extraction of a portion of the cargo on a ship, or the beginning of the unloading process from the ship’s holds. In modern context, break bulk is meant to encompass cargo that is transported in bags, boxes, crates, drums, or barrels – or items of extreme length or size. To be considered break bulk, these goods must be loaded individually, not in intermodal containers nor in bulk as with liquids or grains.

What is Break Bulk Shipping? The term break bulk comes from the older phrase “breaking bulk” which is the extraction of a portion of the cargo on a ship, or the beginning of the unloading process from the ship’s holds. In modern context, break bulk is meant to encompass cargo that is transported in bags, boxes, crates, drums, or barrels – or items of extreme length or size. To be considered break bulk, these goods must be loaded individually, not in intermodal containers nor in bulk as with liquids or grains.